On August 14th, a magnitude 7.2 earthquake struck the Tiburon Peninsula west of Haiti’s bustling capital Port-au-Prince. Impacts of the earthquake, similar in magnitude to that of 2010, were immense – but this time compounded by preceding political and public health crises (Covid-19), and followed just a few days later by tropical cyclone Grace.

Yet, the difference compared to 2010 was that the Caribbean Catastrophe Risk Insurance Facility (CCRIF) made its largest-ever payout (US$ 40 million) to support disaster relief in the country. Emergency assistance delivered by the government and international partners and financed from the insurance payouts has since then saved hundreds of lives and livelihoods.

Insurance and risk finance as an adaptation strategy

The above example illustrates that insurance against disasters, including climate-related events such as droughts or tropical storms, is becoming a widely-used adaptation strategy for governments, businesses and individuals. Climate and disaster risk finance and insurance instruments– such as the insurance protection provided by sovereign risk pools (for definition, see Glossary) – are gaining attention as key tools to cushion vulnerable people from the impacts of extreme events, not least under the InsuResilience Global Partnership (IGP). Evidence of this trend is contained a recent NAP Global Network and IGP report, showing that 90% of national adaptation plans (NAPs) include the intention to use and scale up insurance.

In line with growing interest by stakeholders and countries, significant funds are being invested into boosting resilience through climate and disaster risk finance and insurance (known in the industry as CDRFI). Yet, more evidence-based decision-making is needed on many conceptual and technical aspects of these solutions. 15 years after the foundation of the first sovereign risk pool, the Caribbean Climate Risk Insurance Facility introduced above, it is time to solidify and build on lessons of what works and what doesn’t. While innovations have improved technical CDRFI on all things from risk modelling, trigger and index design for parametric insurance (see Glossary), to distribution and payout channels, a more holistic learning culture is needed to cross-fertilise and prioritise the most impactful work.

Enhancing the evidence base for more impactful solutions: The CDRFI Evidence Roadmap

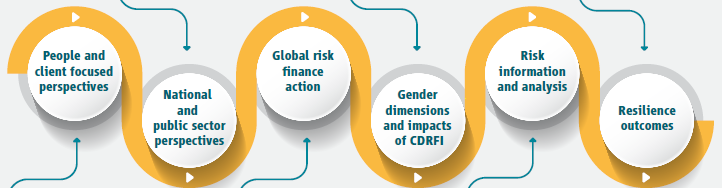

Responding to this need, a roadmap setting out the central questions for more and better CDRFI was drafted through a collaborative process. Following a multi-day workshop hosted by the Munich Climate Insurance Initiative in 2020, this process of refining the roadmap was conducted under the auspices of the InsuResilience Impact working group. The roadmap contains 43 evidence priorities clustered in six evidence themes (shown in figure 1).

Figure 1: Evidence themes covered in the Roadmap

The Evidence Roadmap aims to gather the most compelling and robust evidence on what works in climate and disaster risk finance and insurance. This will ultimately improve the tangible difference CDRFI can make to the lives of poor and vulnerable people. Examples from the list of 43 questions identified in the roadmap are:

- What impacts (if any) do CDRFI interventions have on psychosocial factors and subjective wellbeing of people and clients, and what are the secondary impacts of any such changes?

- What is the impact of support provided with pre-arranged finance for governments? What are the welfare, economic and fiscal stability impacts of macro-level CDRFI instruments?

- Do subsidies of CDRFI represent good use of public resources in a given context and how is this determined?

The Roadmap will guide research and evidence activities in the CDRFI arena in the coming years, gathering support behind a common research agenda.

Join us for the Evidence Roadmap launch at COP26

The Evidence Roadmap will be unveiled just prior to COP at the InsuResilience Annual Forum from 28-29 October. Given the centrality of the roadmap to future research work in the wider resilience space, its official launch event will be held at the COP26 Resilience Hub (event details here). The launch event will bring together academia, implementing partners, governments, civil society and donors to discuss what each actor group can do for improved evidence generation and use.

Conclusion

The Evidence Roadmap is aiming to build up momentum for a enhanced evidence base for better CDRFI. Aiming to spur new investments into evidence for greater reach and effectiveness of insurance and risk finance solutions, the CDRFI Evidence Roadmap can help to unlock the potential that CDRFI bears for those exposed to natural disasters and urgently in need of protection – such as Haitian citizens affected by earthquakes, tropical storms and a global pandemic.

Click here to access the complete Evidence Roadmap.