Programmes & Projects

It is our ambition to provide financial protection against climate and disaster risk

Projects

Programmes

Target Group

Case Studies

InsuResilience Around the Globe

In 2021, 24 implementing programmes were operating under the InsuResilience umbrella with 324 projects in 108 countries.

The following map shows all active projects and aggregates information on the country level. The country circles indicate the number of projects per country. By clicking on a country circle, you can find out which programmes operate in the respective country, how many people in the country benefit from our solutions and how those figures disaggregate across hazards, instruments, and programmes. It is also indicated whether a comprehensive Disaster Risk Finance strategy is under development.

The different available colour shadings indicate levels of overall risk, vulnerability and readiness for financial solutions per country (only available for countries with active IGP projects).

Methodology:

InsuResilience M&E Framework

InsuRisk Assessment Tool

| Higher | Lower | ||||

| Overall Risk | |||||

| Vulnerability | |||||

| Readiness |

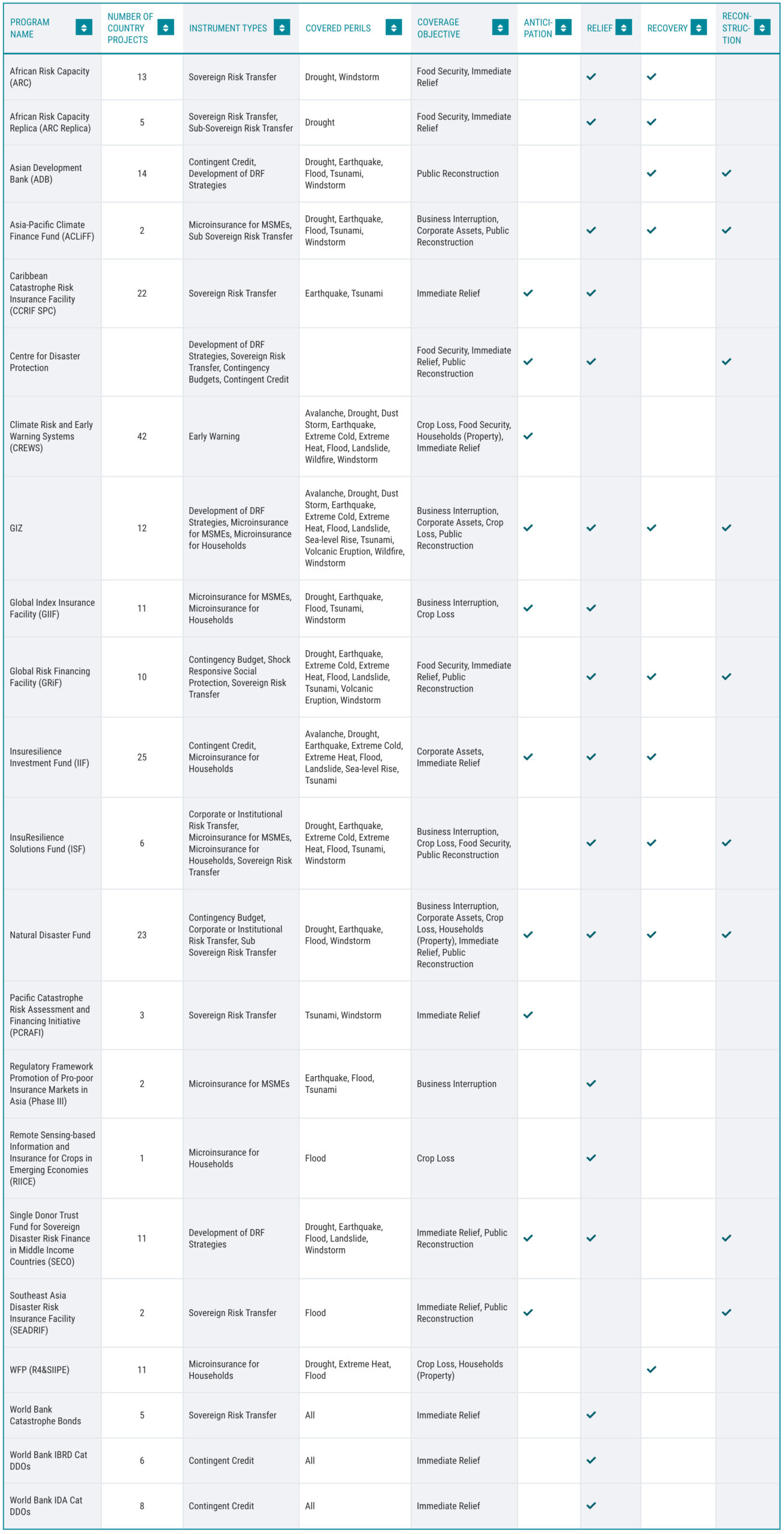

Overview of InsuResilience Programmes

The 24 implementing programmes support the development of the full range of CDRFI instruments and build up financial protection against the majority of climate-related hazards.

Target Group

The InsuResilience Global Partnership has a dedicated focus on poor and vulnerable people. As per HLCG decision in June 2021, the target group is defined as follows:

„The target group of the InsuResilience Global Partnership are poor and vulnerable people who live in countries with a considerable vulnerability to climate change. This currently includes all individuals living on less than $15 PPP per day in member countries of the V20 Group or countries on the DAC list of ODA recipients. It is recognized that to target vulnerability such income threshold is limited to the extent that it does not consider risk exposure of individuals. This can be addressed through additional research, helping to ensure the Partnership’s target group is captured adequately.“

M&E Background Note, p. 3

Experiences from the field

Learn more about our projects on the ground, by having a look at our latest case studies.

Nepal: introducing index-based insurance for flood-prone communities

Nepal’s smallholders face severe weather risks such as flooding, landslides and windstorms. A partnership headed by Practical Action and co-funded by the InsuResilience Solutions Fund (ISF) is developing an innovative insurance approach to introduce index-based insurance to flood-prone communities in western Nepal. The aim is to increase the resilience of smallholder farmers against flood events. The insurance is bundled with agricultural advisory services and will cover yield losses if there is a hazardous flood event.

Developing Meso-Level Disaster Risk Management Approaches for Climate Risks in Ghana

The Greater Accra Metropolitan Area (GAMA) is Ghana ́s economic hub and it is exposed to floods almost every year. Given that the impact of flooding is often catastrophic, there is an urgent need to enhance GAMA’s resilience and move to a proactive disaster risk management approach. The Strategic Alliance between GIZ and Allianz Re has therefore empowered three municipalities in GAMA to adopt an Integrated Disaster Risk Management (IDRM) approach with the aim of increas- ing urban resilience. This encompasses the design of a flood risk-transfer solution at the sub-national level for publicly managed assets like schools and markets.

Better Weather Protection for Tanzanian Farmers

Farmers in Tanzania struggle with rising climate risks. One Acre Fund (OAF), a non-profit social enterprise, has partnered with Global Parametrics (GP), a specialist provider of climate risk protection, to offer innovative protection for farmers. They have pioneered the use of GP’s new Water Balance Index to protect OAF’s network of 70,000 smallholder farmers in Tanzania against drought and excess rainfall. This weather index solution facilitates a rapid financial response at affordable rates to promote resilience among farmers.

Making Access to Insurance Happen for People with Disabilities and Small Businesses and Micro-entrepreneurs

Most farmers and micro entrepreneurs in El Salvador are exposed to various economic and weather-related shocks threatening their livelihoods and food security. However, they lack adequate and affordable insurance to protect their productive activities. The World Food Programme (WFP) El Salvador is collaborating with local partners to bridge these gaps by piloting an innovative insurance solution that protects farmers, micro-entrepreneurs and small businesses against business interruption due to excess rainfall, drought and earthquake. In 2021, nearly 4,800 people benefited from insurance, including 47% of businesses being led by women.