On the 9th of June 2023, the InsuResilience Global Partnership’s Annual Forum was held in Bonn, Germany, and online – in a hybrid setting for the very first time – to reflect on the road travelled so far, achievements and the way ahead for the Climate and Disaster Risk Finance and Insurance community under the Global Shield against Climate Risks.

While just a few hundred meters away the meeting of the UNFCCC’s subsidiary bodies was in full swing, the Annual Forum highlighted the Global Shield against Climate Risks, a joint V20/G7 initiative launched at COP27, to increase the financial protection of vulnerable people and countries against the impacts of climate risks. Building on the innovative financial instruments developed and tested under the InsuResilience Global Partnership, the Global Shield will systematically analyse protection gaps in vulnerable countries, based on evidence, to design, fund and implement integrated support packages, following the principles of country ownership and inclusive in-country coordination.

Starting the day with a “Keynote Choir”

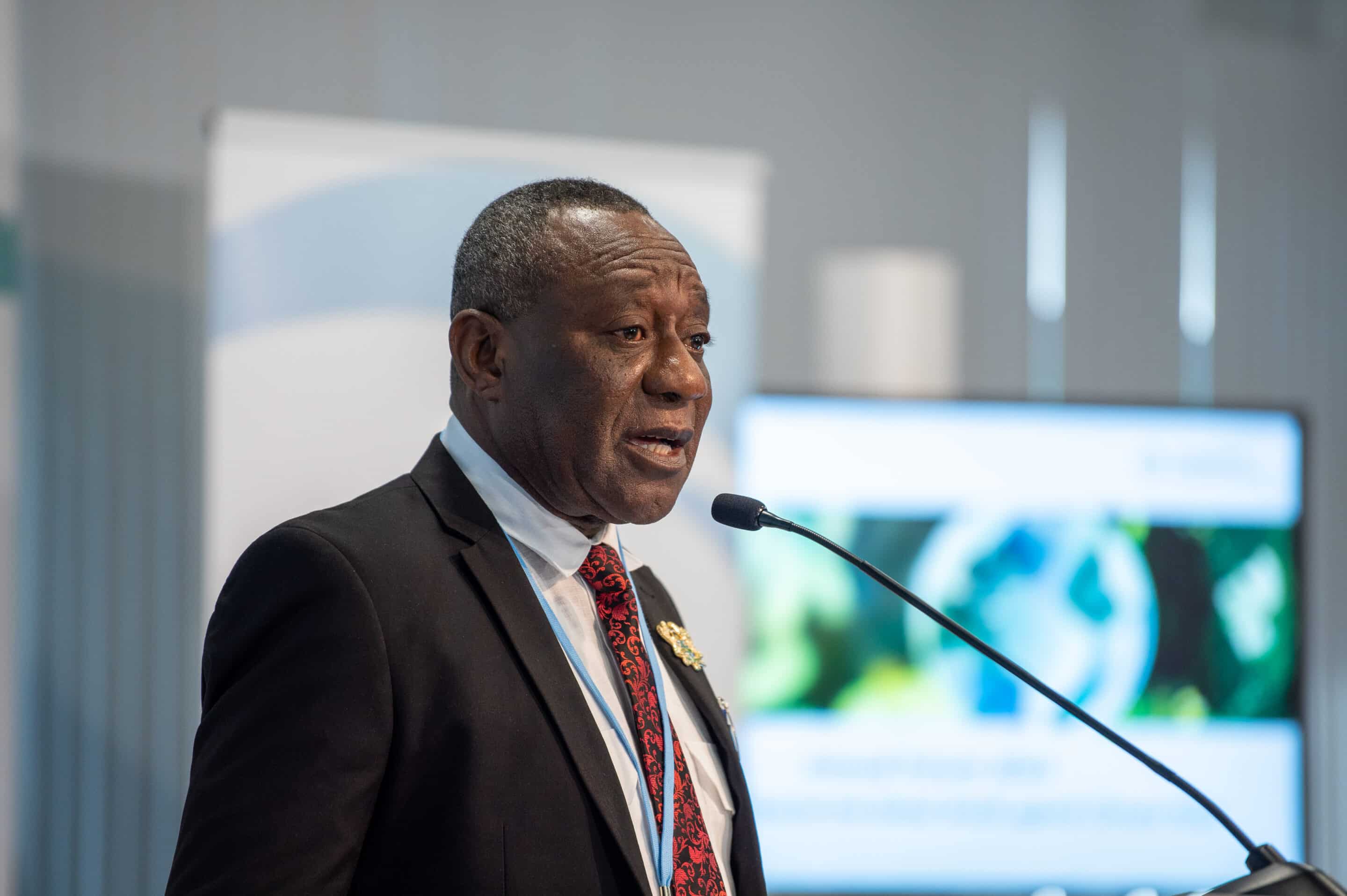

After a warm welcome by moderator Minu Hemmati, who guided the audience through the event, the scene for the day was set by the partnership’s Co-Chair H.E. Seedy Keita (Minister of Finance and Economic Affairs of The Gambia), Hon. Dr. Henry Kokofu (Special Envoy of the Climate Vulnerable Forum Presidency of Ghana) and Dr. Heike Henn, who spoke on behalf of Co-Chair Bärbel Kofler, Parliamentary State Secretary to the German Federal Minister for Economic Cooperation and Development. In their opening remarks, the speakers emphasised that addressing the financial protection gaps in climate-vulnerable economies requires flexible and responsive financing solutions that complement the UNFCCC Loss & Damage fund and put affected countries in the driver’s seat.

In the following “keynote choir”, as it was aptly put by Rowan Douglas, Director of the Insurance Development Forum, representatives of the COP28 Presidency, the private sector, civil society, and donor countries shared their perspectives on the Global Shield, its alignment with their own ambitions, and possibilities for engagement. The different impulse speeches showed the excitement and new dynamic the Global Shield is bringing to the community of stakeholders engaged in dealing with climate risks. Red Constantino, Deputy Chair of the CVF Expert Advisory Group, pointed out that the Global Shield is “an arena that seeks to rebuild trust” in the challenging context of UNFCCC climate negotiations.

Hon. Dr. Hentry Kokofu (1), Dr. Heike Henn (2), Rowan Douglas (3), Red Constantino (4) (© Markus Quabach)

Unlocking the Global Shield’s Potential – Practitioner’s Perspectives

Mutual trust and collaboration were also central tenets in the subsequent presentation by Theodore Talbot, former chief economist of the Centre for Disaster Protection, who discussed the Global Shield In-Country Process, an inclusive multi-stakeholder consultation based on the principles of country leadership, transparent technical support and financing, which is at the heart of the country-specific support packages provided by the Global Shield.

For the ensuing panel discussion, Theodore was joined by Anne Kamau, Aholotu Palu and Jan Kellett – all distinguished experts in the field of prearranged climate and disaster risk finance across the globe – who shared valuable insights on the implementation of financial protection in various country contexts and sketched the opportunities and risks for the Global Shield to move from ambition to tangible action.

Fltr: Minu Hemmati (moderator), Jan Kellett, Anne Kamau, Aholotu Palu, Theodore Talbot (© Markus Quabach)

Thematic Deep-dives, Financing Vehicles and a Snapshot of Gender-smart Approaches

In the afternoon, five breakout sessions allowed participants to discuss in depth about how the Global Shield can support and learn from existing initiatives such as the Anticipation Hub, the Insurance Development Forum, the InsuResilience Evidence Roadmap or the Fit-for-Climate Global Financial System of the Accra-Marrakech Agenda.

A third, more technical part of the event provided clarity on the Global Shield Financing Structure, which is part and parcel of the Global Shield’s mission to make the global risk financing architecture more sustainable, coherent and sustained. The three Global Shield-focused financing vehicles, the Global Shield Solutions Platform, the Global Shield Financing Facility, as well as the CVF & V20 Joint Multi-Donor Fund presented their mandate, catalogue of instruments and the breadth of implementing partners they engage with for the delivery of Global Shield support packages.

“Unlocking a more equitable future”, a lively session presented by the InsuResilience Centre of Excellence on Gender-smart Solutions, highlighted concrete examples of how gender considerations have been integrated into Climate and Disaster Risk Finance and Insurance programmes. The panellists emphasised that the learnings from programmes championing gender-smart approaches should be taken up and integrated into the set-up of the Global Shield.

Overall, the discussions reflected how Climate and Disaster Risk Finance Solutions have become an integral part of holistic approaches to climate risk management and social protection systems and play an increasing role in major global political agendas, such as funding arrangements for Loss & Damage under the UNFCCC.

Impressions of the panel discussion: Dr. Annette Detken and Kars-ten Löffler (1), Simon Hagemann (2), Sara Ahmed (3)

(© Markus Quabach)

The way ahead: From the InsuResilience Global Partnership to the Global Shield Community

In her closing remarks, Dr Astrid Zwick, Head of the InsuResilience Secretariat and designated Co-Director of the Global Shield Secretariat, pointed at three components that need to be built to transform the global risk financing architecture: A new model of collaboration and pooling resources, country ownership and participation to cultivate a demand-side approach to climate and disaster risk finance, and thirdly integrated and systematic approaches to provide more leverage.

The InsuResilience Global Partnership, with its 29 programmes active in 123 countries, provided a strong foundation for the Global Shield: While remaining committed to delivering on the partnership’s strategic framework, Vision 2025, all members and supporters of InsuResilience are invited to join the Global Shield Community and support the roll-out of support packages in the Global Shield Countries.

The transition process from the InsuResilience Global Partnership to the Global Shield Community will be facilitated by the newly established Global Shield Secretariat – building on the former InsuResilience Secretariat – and extended in close collaboration with the V20 Group.

Dr. Astrid Zwick and Minu Hemmati (© Markus Quabach)