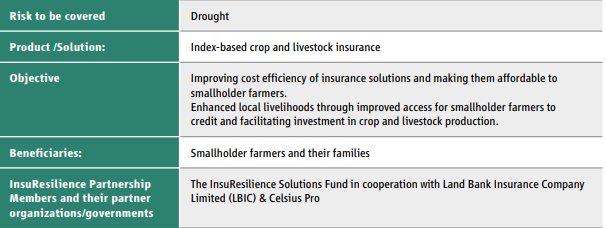

In 2015, South Africa was hit hard by a severe drought and this particularly threatened the livelihoods of smallholder farmers. The InsuResilience Solutions Fund enables the Partnership to work together with the local insurance industry to strengthen resilience by providing access to climate risk insurance for the farmers affected. The project will enhance local livelihoods by improving access to credit, facilitating investment in crop and livestock production, and creating resilience and stability.

South Africa is extremely vulnerable to the impacts of climate change and the country is particularly prone to recurring droughts. Its subtropical climate is characterized by a low rainfall index and a high level of variability. The agricultural sector uses 80 percent of the available land and two thirds of the available water. Since most of the agriculture is rain-fed, extreme weather events can exert devastating consequences on the livelihoods of large sections of the population and on economic development alike.

In mid-2015 and early 2016, a severe drought drastically reduced water supplies and agricultural production in South Africa. Maize and other crops failed to thrive and livestock was at risk of starvation. Smallholder farmers and their families were at high risk of losing their source of income and going hungry as well. Drought-related economic loss was estimated at close to half a billion US dollars. Although insurance was able to effectively reduce vulnerability, less than one percent of smallholder farmers currently have access to agricultural insurance. This leaves an estimated 1.7 million smallholder and subsistence farmers uninsured against risks arising from extreme weather events such as droughts.

The InsuResilience Solutions Fund (ISF) tackled this problem by signing a grant agreement with South African Land Bank Insurance Company and Celsius Pro. The intention of the project is to develop and introduce innovative index-based insurance to cover crops and livestock for smallholder farmers in South Africa by June 2021. As a government-owned institution, Land Bank is mandated by the government to facilitate access by the poor and vulnerable population to financial services. In order to offer insurance protection to people with no insurance cover, Land Bank Insurance Company is partnering with Celsius Pro. This highly experienced Swiss Insurtech company is specialized in industrializing indexbased insurance solutions to mitigate the effects of adverse weather and natural catastrophes. Celsius Pro will provide an automated insurance administration platform to improve the cost efficiency of insurance solutions and make them affordable for smallholder farmers.

Insurance payouts ensure a minimum income for smallholder farmers and enable them to build up financial and food security even in times of drought. The project will contribute to enhanced local livelihoods by improving access to credit for smallholder farmers, facilitating investment in crop and livestock production, and creating resilience and stability. The InsuResilience Solutions Fund provides co-funding and advisory services, while the Partnership commits its own meaningful financial contribution amounting to more than 50% of the requested funding. The project contributes to the objectives of the InsuResilience Global Partnership and aims to reach 240,000 people by 2021.

Contribution by Annette Detken And Lena Laux (Insuresilience Solutions Fund)