The human and economic losses from disasters across the globe are huge, and the data show that these losses continue to grow, driven by factors ranging from increases in wealth and exposure in high hazard areas, through to climate change. Estimated global economic losses from disasters during 2017 and 2018 totalled more than US$500 billion – with US$219 billion insured (Swiss Re Sigma, April 2019). However, for low-income nations the portion uninsured is often in excess of 90 percent. And it is these nations that are most frequently hit the hardest: direct economic losses from disasters as a percentage of GDP have been shown to be 14 times higher in low-income countries than high-income countries (Ranger and Surminski, 2013).

The devastation wreaked in the Caribbean by Hurricanes Irma and Maria in 2017 highlighted the vulnerability of these small island states – where economic losses in some cases were multiples of GDP – and the vital role of infrastructure in both mitigation of impact, and improved recovery. In Puerto Rico, even nine months after Hurricane Maria, approximately 1,000 households remained without power. Rapid restoration of critical infrastructure relies on the adequacy of infrastructure design to future risks, good maintenance practices and ex-ante planning, including ready access to finance in the days and months after an event.

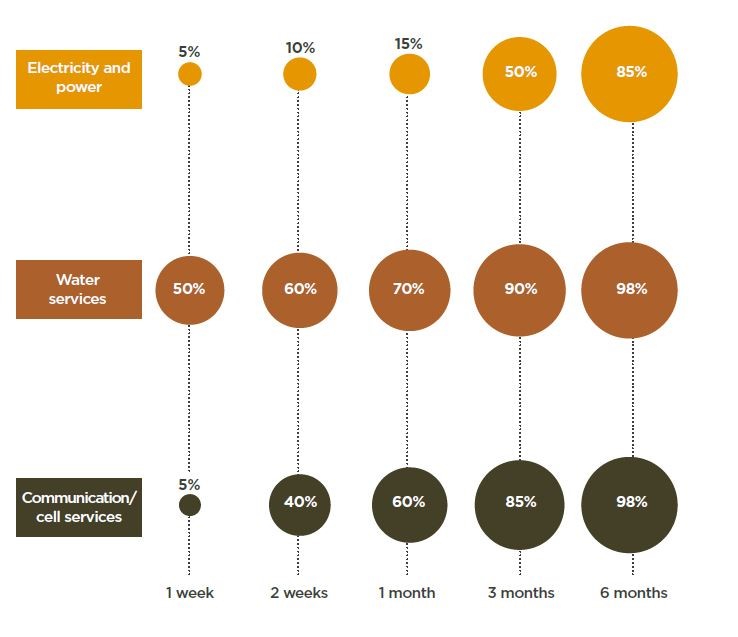

Figure 1 The restoration of Puerto Rico’s services in the first six months post Hurricane Maria landfall (by availability)

Resilience-based design for new infrastructure provides an opportunity for future proofing that should be seized. However, infrastructure can last 50 to 100 years, presenting a huge challenge in maintaining and renewing both new and existing infrastructure. The scale of the problem is compounded by the fact that the benefits of resilience investments can take a long time to be fully realised and can be hard to quantify at the time of investment. High discount rate environments can also result in underinvestment in resilience. There is an opportunity for innovations in resilience finance to make some of these benefits available upfront in order to incentivise investment.

Resilience-based design for new infrastructure provides an opportunity for future proofing that should be seized. However, infrastructure can last 50 to 100 years, presenting a huge challenge in maintaining and renewing both new and existing infrastructure. The scale of the problem is compounded by the fact that the benefits of resilience investments can take a long time to be fully realised and can be hard to quantify at the time of investment. High discount rate environments can also result in underinvestment in resilience. There is an opportunity for innovations in resilience finance to make some of these benefits available upfront in order to incentivise investment.

The Innovation Lab

Against this backdrop, the Centre for Disaster Protection convened its first Innovation Lab in January 2018, held in partnership with Lloyd’s and supported by RMS together with Vivid Economics and re:focus partners. More than 50 experts from across the finance, engineering, humanitarian and development communities convened to workshop real-world use-cases, with the purpose of catalysing innovation to finance resilient infrastructure. Participants were tasked with the question: How can the future dividends of resilience be monetized to incentivize action now?

Products needed to meet four key criteria. They should (1) motivate the development of resilient infrastructure; (2) monetise the associated benefits of resilience; (3) deliver those resilience benefits up front such as to reduce financing needs; and finally (4) encourage financial resilience through risk transfer.

The Resilience Dividend

The resilience dividend is defined as the net benefits of resilience and can be thought of as consisting of avoided losses – benefits that are only accrued when an event happens – and co-benefits, which can be realised in the absence of an event. Avoided losses range from those which fall within the typical domain of insurance – reduction in physical damage to assets, harm to life and business interruption – to the more difficult (but not impossible) to quantify downstream socioeconomic impacts. Co-benefits might include a reduction in insurance premiums, an increase in property values or growth in economic activity resulting from a lower risk environment.

Insurance savings are a low-hanging fruit for monetising the resilience dividend and the products arising from the Innovation Lab largely focused on this aspect, also meeting the objectives of encouraging both physical and financial resilience. The ‘technical price’ of insurance is a function of the expected loss in any one year, typically estimated using catastrophe models. In the absence of other factors, you would expect to pay 50 percent less insurance premium if a more resilient design reduced your average annual loss by 50 percent. This is complicated by market dynamics, cross-subsidisation and regulatory factors, which need to be considered in product design.

The Products

Four products emerged from the Innovation Lab and were further developed in a report published by Lloyd’s in association with the UK’s Centre for Disaster Protection, Risk Management Solutions, Vivid Economics and re:focus. The associated technical report can be found here.

Insurance-linked Loan Package

Product: Embedded insurance component within the concessional loan products offered by international financial institutions to finance new or upgraded infrastructure.

Mechanism: A portion of the loan amount is allocated to a resilience fund to cover the future costs of insurance. If a resilience-based design option is chosen, future insurance savings arising from the associated risk reduction would be transferred to the financing part of the loan. This model is predicated upon the take-out of insurance but where the savings in insurance offset or partially offset the additional cost of building resiliently. The resilience fund itself could be a trust fund or special purpose vehicle and its purpose could be extended to cover maintenance costs.

Use Case: Large infrastructure projects in high-risk regions where there is a need to consider both the long term financial and physical resilience of the assets.

Resilience Impact Bond

Product: Pay-for-performance model which has been used successfully in social impact bonds and development impact bond models, adapted to achieve key resilience objectives.

Mechanism: An impact investor supplies the project capital, carries out the project through an implementation agent, and receives a return on investment determined by the success of the contract. Success is measured by pre-defined criteria and assessed by an outcomes funder, who repays the initial capital outlay and provides the performance-linked return. The outcomes funder can ensure they are paying for results against a set of physical, operational and financial resilience objectives. Such a project could be the reconstruction or retrofit of a portfolio of schools. Criteria can be measurable outcomes such as the number of days of service interruption or based on action-based outputs such as the creation of a robust emergency preparedness plan.

Use Case: Likely to work best at scale due to transaction costs and when an outcomes funder is motivated to be able to incentivise and monitor the positive impact of investments.

Resilience Bond

Product: Concept developed by re:focus partners as part of the RE.bound program and further adapted for a development setting. Based on the catastrophe bond, an instrument that transfers risk from a sponsor/risk holder to a set of investors, with savings made as resilience investments are completed.

Mechanism: The bond principal, paid by investors, is placed into a special purpose vehicle, and in the absence of a pre-defined catastrophic event, investors receive coupon payments and the return of the bond principal at maturity. If a triggering event occurs, the bond principal can be used to cover disaster losses and/or provide rapid funding for emergency response. The resilience bond aligns this structure with planned resilience projects and allows for a variable coupon that is reduced as resilience measures are implemented. The generated savings can be ring-fenced for future project financing. In the development context, stakeholders with an interest in reducing future disaster losses could form a sponsoring consortium, aligning private, public and development interests.

Use Case: Large scale resilience interventions where multiple stakeholders can benefit from the lower risk environment.

Resilience-Service Company (ReSCO)

Product: Concept inspired by the energy service company (ESCO) where the company, a non-profit or commercial venture, designs and implements an energy saving project for a home or business, and then receives the benefit of the reduction in energy cost to repay the initial outlay. In the case of the ReSCO, the company would carry out a retrofit to a building and receive the savings in insurance premium resulting from the lowered risk.

Mechanism: The resilience dividend is monetised through the insurance savings and the asset owner benefits by a reduction or removal of upfront costs, with the resilience dividend transferred to an entity that is willing to wait to recoup their investment.

Use Case: The ReSCO relies upon securing risk-linked reductions in premium in a predictable fashion and is likely best suited to scalable projects such as home retrofits where a significant saving can be achieved with a low-cost intervention.

The Road Ahead

The products proposed in the Lloyd’s report form the potential building blocks to future solutions that incentivise and, in some cases, reduce the cost of resilient infrastructure. Risk transfer and risk reduction are two pieces of the same puzzle – by investing in risk reduction you should be able to make risk transfer cheaper. There are barriers to overcome. The ability to robustly quantify the benefits of resilience and the reliable recognition of such risk reduction by insurers have a critical part to pay in incentivising resilience and permitting the creation of innovative products. By trialling such products and continuing to invest in understanding the true ROI of resilience we can make progress towards incentivising resilient infrastructure.

About the author:

Charlotte Acton is a director in the Capital and Resilience Solutions group at RMS, helping public and corporate entities understand their risk, quantify the potential for risk reduction, and transfer risk into the (re)insurance and capital markets. Acton leads RMS involvement in the design and risk analysis of catastrophe bonds and other alternative risk transfer mechanisms. She has overseen the trigger design for award winning transactions such as MetroCat Re, the first ever storm surge bond, sponsored by the Metropolitan Transportation Authority in New York, PennUnion Re, covering Amtrak-owned infrastructure along the northeast corridor from hurricane and earthquake risk, and the Bosphorus transactions for the Turkish Catastrophe Insurance Pool. She has contributed to transactions in the life and health space, including the first longevity-linked 144A catastrophe bond.

Acton works on the application of catastrophe modelling in quantifying the cost-benefit of resilience and in innovative financing. This includes RMS involvement in the RE.bound program, an initiative launched by re:focus in partnership with The Rockefeller Foundation, Swiss Re and Goldman Sachs. RE.bound set out the framework for the Resilience Bond concept, designed to help public entities manage the risk of extreme events, whilst promoting investment in resilient infrastructure.

Acton graduated with honours from the University of Cambridge as a Master of Natural Sciences. She went on to complete a PhD in seismology at the Bullard Laboratories, University of Cambridge, focusing on the crustal and upper mantle structure of the Indo-Eurasian collision zone. Acton is a published author in peer-reviewed journals.